Contents

The global insurance analytics market is projected to expand at a CAGR of 15.1% between 2024 and 2032 to reach $44.77 billion. This highlights that insurance companies already recognise the many benefits of data analytics. Data science has made immense progress in extracting value from disparate and disjoint or related and comprehensive datasets. Advanced techniques for modelling insurance data and analytics offer invaluable insights. These insights are used across the industry to drive decisions, improve insurance operations, and manage risk.

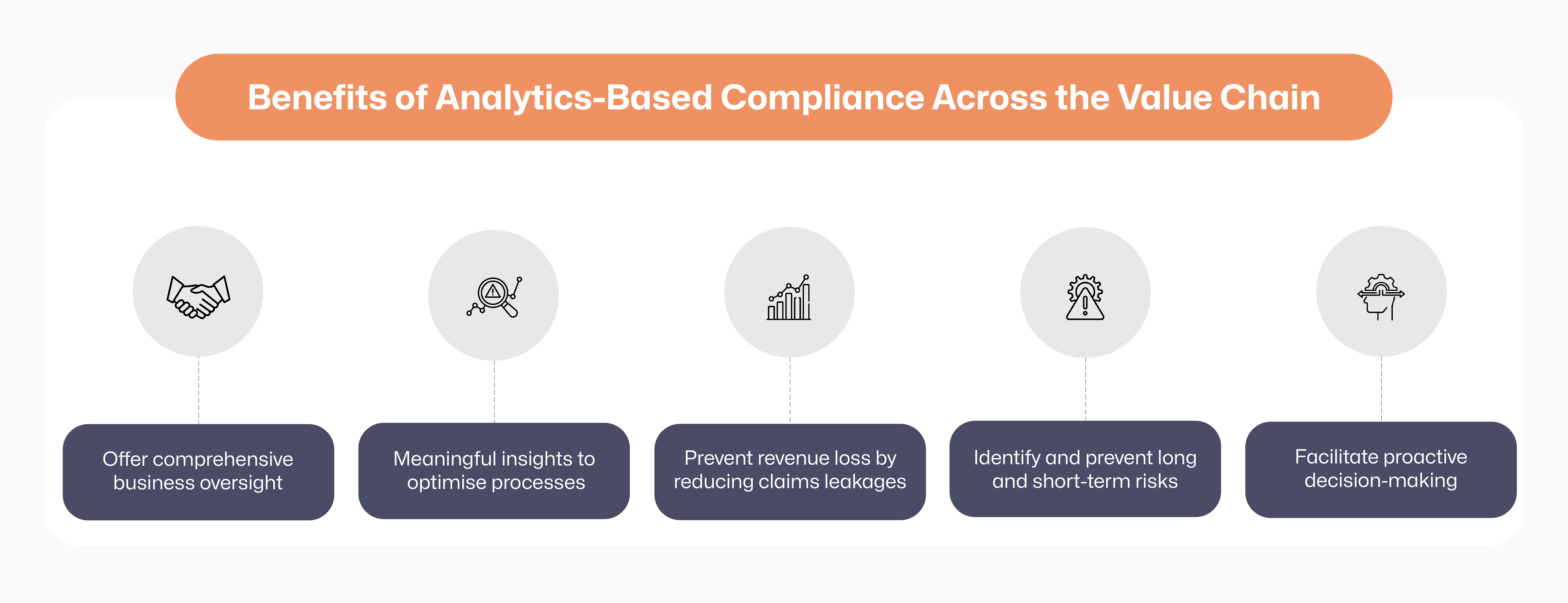

Personalisation and the ability to offer services on-demand are the direct benefits of data models for insurance companies. Being one of the most scrutinised sectors, insurance companies must extend their data capabilities to improve compliance operations.

Prioritising Compliance with Data

While the penalties for non-compliance are soaring, regulators continue to amend the existing guidelines and even release new ones. This adds to the complexity of compliance management and updating legacy systems. This calls for developing an efficient compliance ecosystem. Leveraging advanced technologies can help drive a compliance strategy that encompasses risk and operations management and evolves with the regulatory landscape. InsurTech companies in India, help insurance providers by leveraging advanced and emerging technologies, including RPA, RegTech, and AI, to improve compliance processes. They provide affordable access to deeper insights.

Drive Process Efficiency

Rule-based process analysis expedites the checking of compliance controls. Automation can be applied to all repeatable and logic-based insurance operations. Intelligent self-learning systems take over intuitive tasks, such as compliance quality checks, data extraction, and algorithm improvement. These systems are powered by cognitive technologies, such as NLP (natural language processing) and GenAI (generative artificial intelligence), which significantly enhance compliance assessment.

Insurance data is scattered across disparate processes in structured and unstructured formats. Advanced data science solutions expedite data cleansing and organising to reduce the time of risk analysis and reporting. NLP-powered document data-extraction capabilities are playing an instrumental role in making such processes more efficient.

Reduce Risks

Predictive analytics is useful for monitoring all data to discover vulnerabilities and enable insurers to proactively address compliance issues. Real-time data monitoring enables flagging anomalies to prevent fraud and money laundering attempts. Automated risk response systems can significantly reduce the impact of an incident, while up-to-date compliance processes reduce the risk of high penalties. Accurate data analytics enables insurers to improve premium calculation and enhance reporting of solvency ratios. Reduced error rates and precise calculations help improve reporting accuracy and lower legal risks.

Instil Agility and Scalability

InsurTech companies in India offer easy-to-integrate, cloud-based compliance solutions. They provide cost-effective ways to monitor and ensure compliance at scale. Cutting-edge technologies, such as immutable digital ledgers (blockchain), improve KCY, AML, and reporting. Detailed trails and documentation ensure that insurance companies can smoothly navigate regulatory audits. Additionally, cloud-based collaborative platforms allow insurance providers to access expertise and skills from across business sectors in one place in a cost-effective way.

Optimise Policy Management

Implications of insurance policies are often difficult for customers and even new employees to understand. A siloed approach to policy development and enforcement and complexity due to regulatory guidelines make it highly tedious to manually manage policies. Data-driven models can seamlessly incorporate these policies. This helps streamline policy modification and review without elevating claims costs. Better policy management with clear actionables ripples down to all decision-making activities.

Share Data

Insurance companies can significantly improve their compliance management by leveraging insights from alternative data. InsurTech companies in India provide cloud-based solutions that enable insurers to access intra-industry and cross-industry data via secure sharing mechanisms. Insights aggregated from diverse sources enhance the accuracy and efficiency of compliance processes.

The Digital Personal Data Protection Act (DPDPA) is one of the newer additions to the compliance map. InsurTech solutions make adapting to evolving regulations easier and faster. Advanced data extraction tools transform or anonymise personally identifiable information (PII) before sharing to help insurers comply with privacy regulations.

Data Best Practices for Insurance Compliance

Here’s a deep dive into the best practices for insurance companies to leverage data and make compliance processes more efficient:

Consistently Monitor Operations Data: Gather insights from mistakes and reinforce previously known facts to keep risk analysis processes up to date.

Assess Compliance Program: Stress-test all policies and compliance controls directly and indirectly to gather insights into their efficacy and accuracy. Use these to improve reporting accuracy and speed.

Track Third Parties: Monitor third-party due diligence and evaluate their impact scope on internal operations.

Ensure the Accessibility of Compliance Policies: Run tests to assess the accessibility of compliance policies and processes. Ensure that all compliance personnel regularly re-visit them to remain updated with the latest requirements as the regulatory environment evolves.

Leverage Cutting-Edge Technologies: Embracing technology is essential for staying ahead of the competition in the rapidly evolving insurance sector. Adopting data-driven practices for decision-making, compliance, automation, and customer experiences position you as an innovative and future-ready organisation.

It is important to think beyond due diligence to effectively optimise insurance operations and resource utilisation across compliance processes. The key is to start by identifying the highest priority risks, compliance requirements, and industry challenges. Next, align all the compliance activities, from personnel training to automation, monitoring, and internal reporting, to fit your business needs. Leverage advanced technologies to help you extract insights from data and use resources efficiently.

Collaborate with InsurTech Experts

A Deloitte report highlighted that the cost of compliance is a massive and unavoidable expense for financial firms. Regulatory compliance costs include personnel salaries, technology management, testing, reporting, and third-party expenses. With IRDAI's guidelines to limit EoM (expenses of management) costs to 30% of the gross written premium, you need more cost-effective compliance management and operations. The authority has even asked insurers to share clear plans to reduce costs and pass the benefits to their customers.

Data-driven automation can significantly lower compliance costs and boost operational efficiency. RegTech (regulatory technology) empowers you to address compliance challenges at scale. These technologies drive compliance management, adherence, and auditing initiatives. InsurTech companies in India like Zopper provide you access to the latest technologies and tools to lower the costs of insurance operations and compliance management. Did you know InsurTech expenditures get you 5% of additional allowance over the IRDAI limit? Therefore, partnering with InsurTech companies in India can be operationally and financially beneficial.

A deep understanding of the business landscape, regulatory environment, and technology makes InsurTech professionals the best-suited partners to drive digital initiatives for insurance companies. They identify the most urgent and impactful compliance areas that require modernisation. A streamlined approach to digitising compliance processes minimises risks and ensures business continuity. This significantly improves regulatory productivity for insurance companies.

Reliable and accurate data is critical to harnessing the potential of insurance analytics. Cloud-based advanced data governance ensures the completeness, consistency, relevance, and accuracy of data by imposing rules in data entry itself. Effective data governance is the cornerstone of establishing data quality standards that translate into business-focused insights. These standards enforce data integrity through continued monitoring, to prevent errors or inconsistencies from penetrating the datasets. The high reliability of data ensures quality insights that drive effective decision-making.

Bibliography: (last accessed on August 28, 2024)

- https://www.fortunebusinessinsights.com/insurance-analytics-market-108489

- https://nordlayer.com/learn/regulatory-compliance/cost-of-regulatory-compliance/

- https://www.gicouncil.in/news-media/gic-in-the-news/synopsis-of-irdai-expenses-of-management-eom-regulations-2023/

- https://www2.deloitte.com/us/en/pages/regulatory/articles/cost-of-compliance-regulatory-productivity.html

- https://riskproducts.pwc.com/insights/why-using-data-to-drive-your-compliance-program-is-more-important-than-ever/

- https://www.astera.com/knowledge-center/ai-powered-data-extraction-insurance/

- https://slksoftware.com/blog/why-is-data-governance-essential-for-the-insurance-industry/

- https://www.damcogroup.com/blogs/insurance-data-analytics-for-insurers

- https://www.wns.com/perspectives/blogs/blogdetail/1178/data-driven-decision-making-transforming-insurance-operations