Contents

Bite-sized insurance for a short duration is no longer a far-fetched dream. Policies like cab ride, appliance, marathon and backpack insurance have already become popular. For small businesses and individuals, affordable, bite-sized insurance policies are a boon. For instance, a ₹5/day insurance to protect them from phishing attacks or their social media accounts from being hacked. These sachet insurance packages often also serve as samples to make a final decision regarding an insurer for more comprehensive coverage, such as life, term, auto, or home insurance.

Transitioning to a more financially secure lifestyle is increasingly crucial, given the rising risks and inflation. The good news is that financial security is increasingly accessible, thanks to insurtech innovations. All a customer needs to do is find a reliable insurance provider equipped with the necessary sachet insurance software.

Understanding Sachet Insurance

IRDAI has taken several initiatives to achieve its “Insurance for All” goal. These include eliminating the wet signature requirement for insurance validation and establishing the Sandbox committee to identify regulations hindering the achievement of the goal. The organisation emphasises leveraging innovation and supporting insurtech companies to enhance financial protection of the masses.

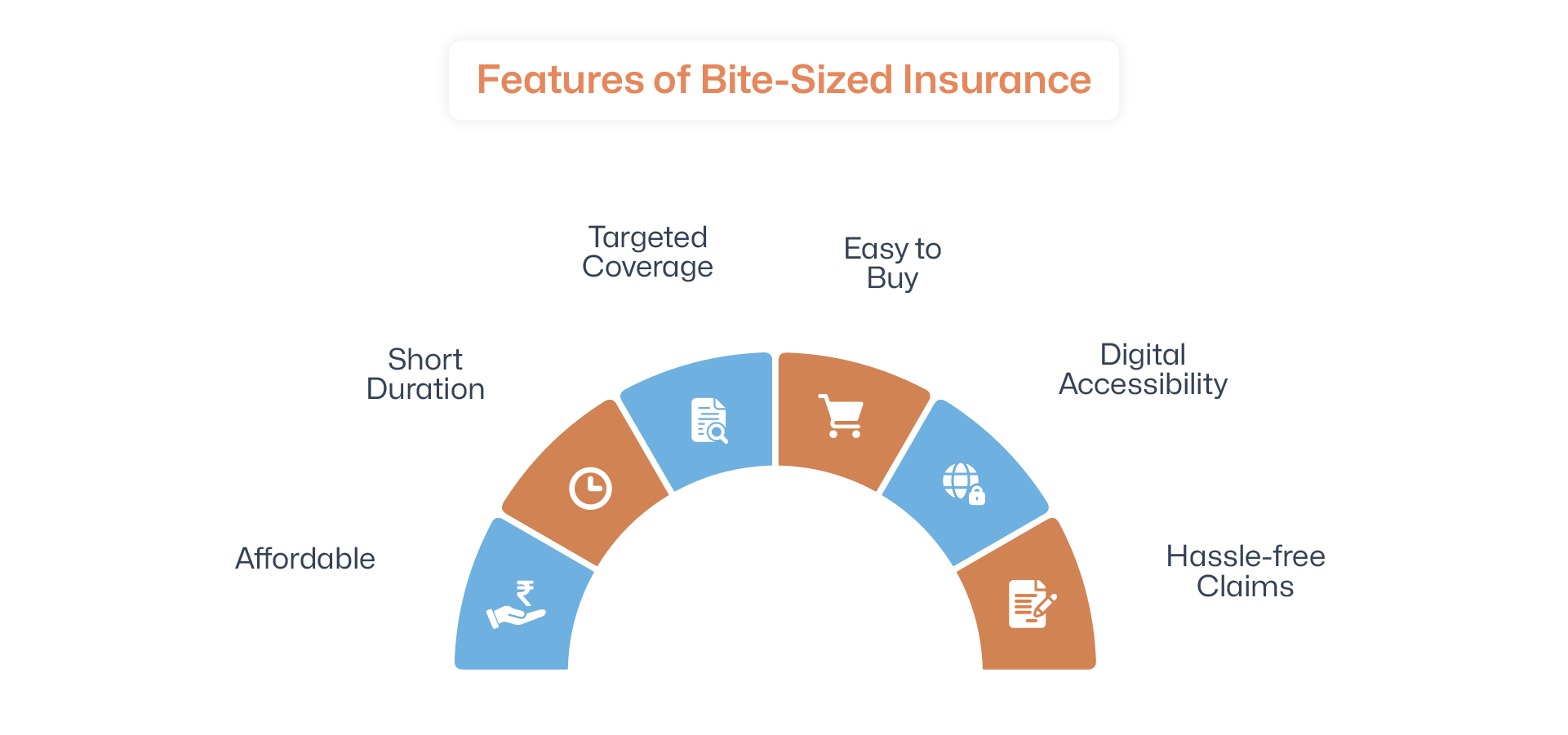

Sachet Insurance is an affordable product for the short term with specific coverage, often available through a digital platform, without the need for extensive documentation.

It protects against targeted risks instead of offering comprehensive coverage. These include extended warranties and low-value credit-risk covers offered by lenders. Premiums for these small-ticket policies may range from ₹49 to ₹99 and are often paid a single time.

In India, railway travel insurance, mobile insurance, eye-wear care, and metro insurance are popular forms of bite-sized insurance. Note that these low-premium, innovative insurance products seamlessly integrate with daily activities and offer targeted coverage against associated risks.

IRCTC, the Indian Railway Catering and Tourism Corporation, has pioneered a 45 paise per passenger model to offer financial protection in case of a train accident. It provides uniform coverage to each policyholder.

Why Choose Sachet Insurance Plans?

Bite-sized insurance addresses the specific risks associated with an unpleasant event. It offers two primary advantages:

- Improved Management of Insurance Portfolios

For instance, a risk of appliance damage during earthquakes for those residing in seismically active zones. This can be added on top of home insurance and can save them from having to place a claim against a more comprehensive plan in case of minor damage. Avoiding claims on a more comprehensive policy can help lower its premiums in the long term.

- Enhanced Coverage

Another example of this could be cab ride insurance, which is often excluded from the usual accidental insurance policy. Thus, bite-sized insurance enhances the coverage you have.

Who Can Buy Bite-Sized Insurance

While sachet insurance targets tech-savvy millennials and Gen Z, there is no entry barrier to accessing these non-traditional products. However, the exact eligibility for claims depends on the individual policy. For instance, backpacker’s insurance will apply only if you lose your backpack while you are at the destination specified while purchasing the policy and during the duration mentioned in the terms.

Bite-sized insurance is different from micro-insurance in that the latter is designed for economically weaker individuals, while the former caters to specific, targeted needs.

5 Tips for Choosing the Perfect Bite-Sized Insurance Policy

Since sachet insurance products are accessible on mobile devices, purchasing them is convenient and quick.

Consider Your Needs

Assess your needs thoroughly. For instance, you purchased a new mobile phone or are planning a trip. You would need a targeted insurance product. But do not use sachet insurance as your only cover. Ensure that you are not compensating for a comprehensive health insurance plan with a temporary dengue cover, given the outbreak in your region. And a small business cannot cover all cyber risks with only a social media hack protection sachet cover. The key is to identify the specific needs of a short timeframe, or vulnerabilities not insured by a comprehensive policy.

Evaluate Your Risks

Consider the most common risks you may face or potential challenges that may arise. For instance, losing our smartphone or passport while travelling abroad or catching a locally common disease. This helps you determine the exact product and coverage duration you will require.

Choose a Licensed Insurer

Picking a digital-first insurer with cutting-edge sachet insurance software and end-to-end services is a good start. Ensure that the provider has experience in the specific domain you are looking for protection in. Since these are quick resolution products, make sure claims can be filed and disbursed electronically.

Carefully Consider the Cost

Weighing the cost against the benefits is essential. Buying a policy just because it is affordable can be counterproductive in case you need to make claims. While sachet policies are affordable, analysing premium deductibles and add-on fees are important. These give you a clearer picture of the coverage you get and out-of-pocket expenses you may have to bear.

Understand the Terms and Conditions

The thing with bite-sized insurance is that it offers very specific coverage. This makes understanding the terms and ensuring that they align with your needs crucial. Checking customer reviews regarding frictionless claims and customer support from the insurer can protect your peace of mind. Be comfortable with an overlap with your comprehensive policies, but only after considering the pros and cons of this overlap.

Heading to a Secure Future

The demand for travel insurance is rapidly rising in India. The travel insurance market is forecasted to reach USD 4.17 billion by 2031.

On-demand, context-based, precise, and personalised risk coverage through mobile devices is the next milestone in insurance. The time is near when a connected wearable device detects the user trekking on snowcapped mountains and recommends a quick frostbite insurance for 5 days. India is poised to be a prime market for the bite-sized insurance segment. The country is home to some of the most innovative insurtech companies, enabling collaboration between insurers and third parties to deepen insurance penetration and improve coverage. These insurtech providers offer API-based sachet insurance software platforms for insurers to connect with consumers directly or through third parties. Choose an insurer with diverse collaborations and high-quality products accessible digitally.