Contents

Digitisation is transforming every aspect of the insurance industry, from policy underwriting to claims processing and customer experience. Innovations in AI, automation and data analytics are redefining the underwriting process flow. Traditionally, underwriters needed to scour vast amounts of paperwork, input the data manually and check historical data for each customer to make decisions. This process was not just tedious and time-consuming but also fraught with challenges, such as the risk of human error, inconsistent decision-making and slow processing times. It also led to accuracy issues during risk assessment, which could hurt both the client and the insurer.

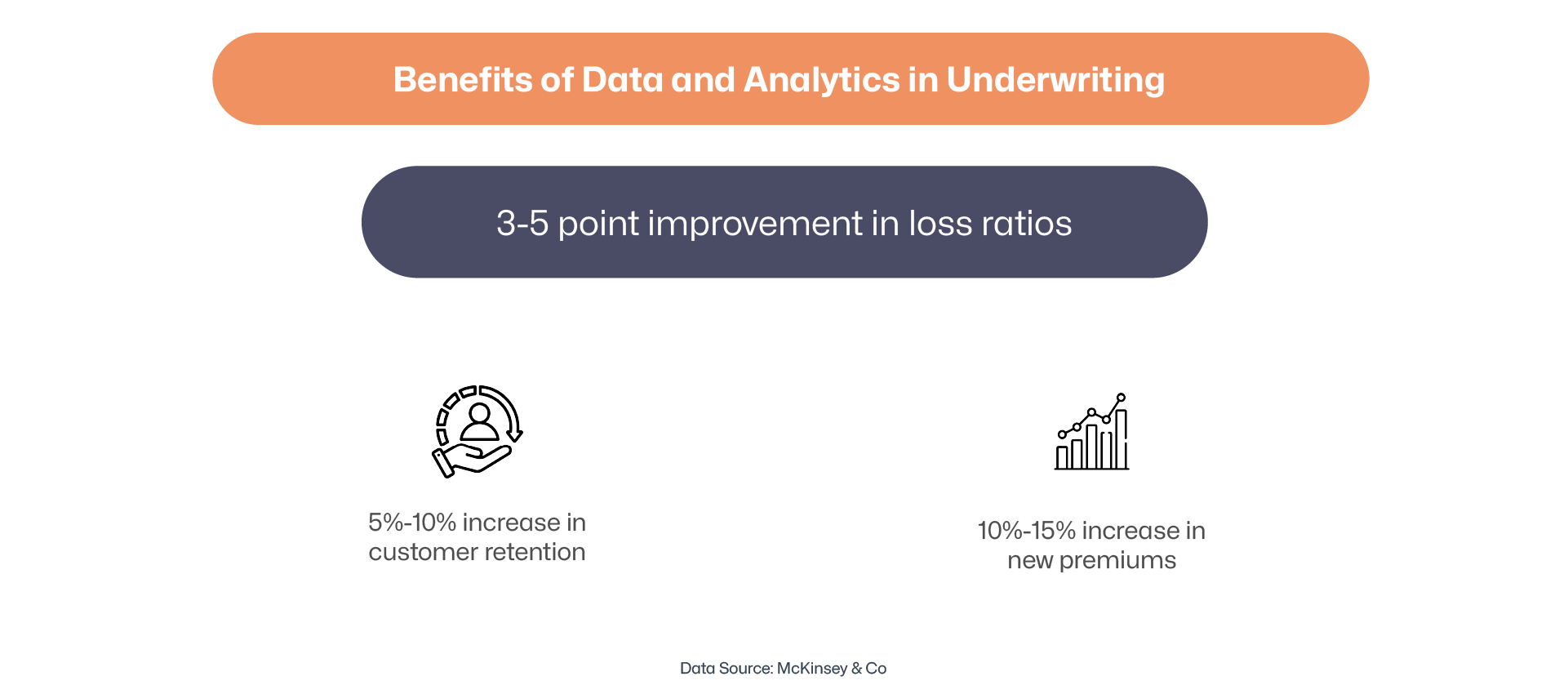

Underwriting is the cornerstone of successful insurance provision. Advancements in technology offer the means to refine this process significantly through access to real-time insurance data and analytics. This allows insurers to make quick, accurate coverage and premium decisions and satisfy customers through frictionless experiences.

Benefits of Real-Time Data Analytics for Insurance Underwriting

Insurtech partnerships are arming insurers with powerful tools to collect and analyse data from diverse sources to improve risk assessment. Insurance companies now have access to vast amounts of third-party data, ranging from open data sources such as government records to business- and industry-specific records. It is estimated that 180+ zettabytes of data will be generated daily by 2025. Having the tools to extract meaningful insights from such vast datasets can be a major differentiator for the insurance sector.

Data analytics powers insurers to identify patterns and assess risks that would otherwise not have been apparent through manual underwriting. For instance, real-time data on driving behaviour can be used to estimate auto insurance premiums, supplementing the policy seeker’s historical claims data. With access to real-time data, insurance providers can proactively respond to risk changes, such as natural disasters. Availability of the most recent data is especially valuable for underwriting for dynamic scenarios, such as health insurance.

Here’s a look at the primary benefits of adopting the latest data analytics solutions from leading insurtech companies in India.

Read More: Insurance Ombudsman: Everything you need to know

Enhanced Speed and Efficiency

Access to real-time data streamlines insurance underwriting, speeding up application processing and verification. Enhanced speed and efficiency mean a larger number of applications can be processed within a short period, benefiting the insurer. On the other hand, customers experience much shorter wait times, which leads to higher satisfaction.

Improved Risk Management

With the most current data, insurers can assess risk patterns, identify emerging risks and adjust policies to account for the changing conditions. In addition, integrated data from diverse sources provides a 360-degree perspective, offering insights into a wide variety of factors from external risk indicators to personal habits. This comprehensive view leads to greater accuracy in underwiring, allowing insurance companies to make more precise and nuanced risk assessments and offer tailored and cost-efficient policies.

Personalised Offerings

Insurtech has made it possible for insurers to access data from unconventional sources, including social media, to analyse customer behaviours, habits, preferences and needs. This allows them to create personalised policies to suit the specific needs of individual customers. Customised recommendations and customer support lead to greater customer retention and loyalty.

Faster Claims Processing

Data analytics allows insurance companies to streamline the claims process. This helps them respond to claims with agility, ensuring faster payouts. The data can also identify fraud and protect the business against false claims.

Data-Driven Decisions

When data from diverse sources is consolidated onto a unified platform, underwriters are empowered to make data-driven decisions. This optimises outcomes and minimises risks for the insurance provider. Plus, predictive analytics facilitates a proactive approach to risk management.

Best Practices in Implementing Data Analytics in Insurance Underwriting

Successful implementation of data analytics for insurance underwriting requires a careful, well-planned approach. Here are some steps that can help:

- Define your objectives: Technology should not be adopted just for the sake of integrating the latest tech tools. Carefully balance technology with business and customer needs. Define your objectives and identify the metrics you will use to evaluate success.

- Determine the governance structure: Put in place ethical guidelines that protect customer privacy and well-defined governance structures for the collection, storage and use of data.

- Partner with the right insurance technology provider: Don’t attempt to build data management and analytics tools from scratch. Technology providers specialising in insurance can offer you highly customisable, flexible and scalable solutions, along with ongoing support. This will save you time, money and manpower.

- Start small and expand gradually: Focus on using data to underwrite a specific line of insurance. Use this experience to hone your processes, automate where possible and optimise operations. This experience will also provide insights into the best way to collect, analyse and utilize data to drive business success.

- Ensure data protection: Prioritising customer data privacy is crucial, not just from the compliance standpoint but also to build trust. Also, the use of cloud computing and AI can increase the vulnerable attack surface for cybercriminals. Establishing clear security policies and measures will keep your customers and organisation protected.

- Monitor, test and improve: AI/ML-powered tools learn as you use them. This makes it important to continuously monitor and test the systems to ensure optimal performance.

- Focus on employee training: Frictionless integration of new tools should be accompanied by seamless acceptance and use of such tools. Training employees can ease the transition to new systems while lowering resistance to change.

Also Read: AI in Insurance: How is AI Transforming Insurtech

Once you have decided to adopt an insurtech solution to analyse data for insurance underwriting, here are some areas where you can apply the solution:

- Predictive analytics: Predictive analytics can help insurers segment policyholders into groups based on risk, preferences and behaviour.

- AI-driven automation: AI-driven automation can streamline the claims process, reducing wait times and improving customer satisfaction.

- Identify potential markets: Data analytics can help insurers identify and target potential markets by providing insights into behaviour patterns and demographics.

- Tailor products: Data analytics can help insurers understand customer needs and preferences, allowing them to develop and tailor products to specific demographics and regions.

- Monitor property values: Data analytics can help insurers monitor changes in property values and market dynamics to ensure that policies remain relevant.

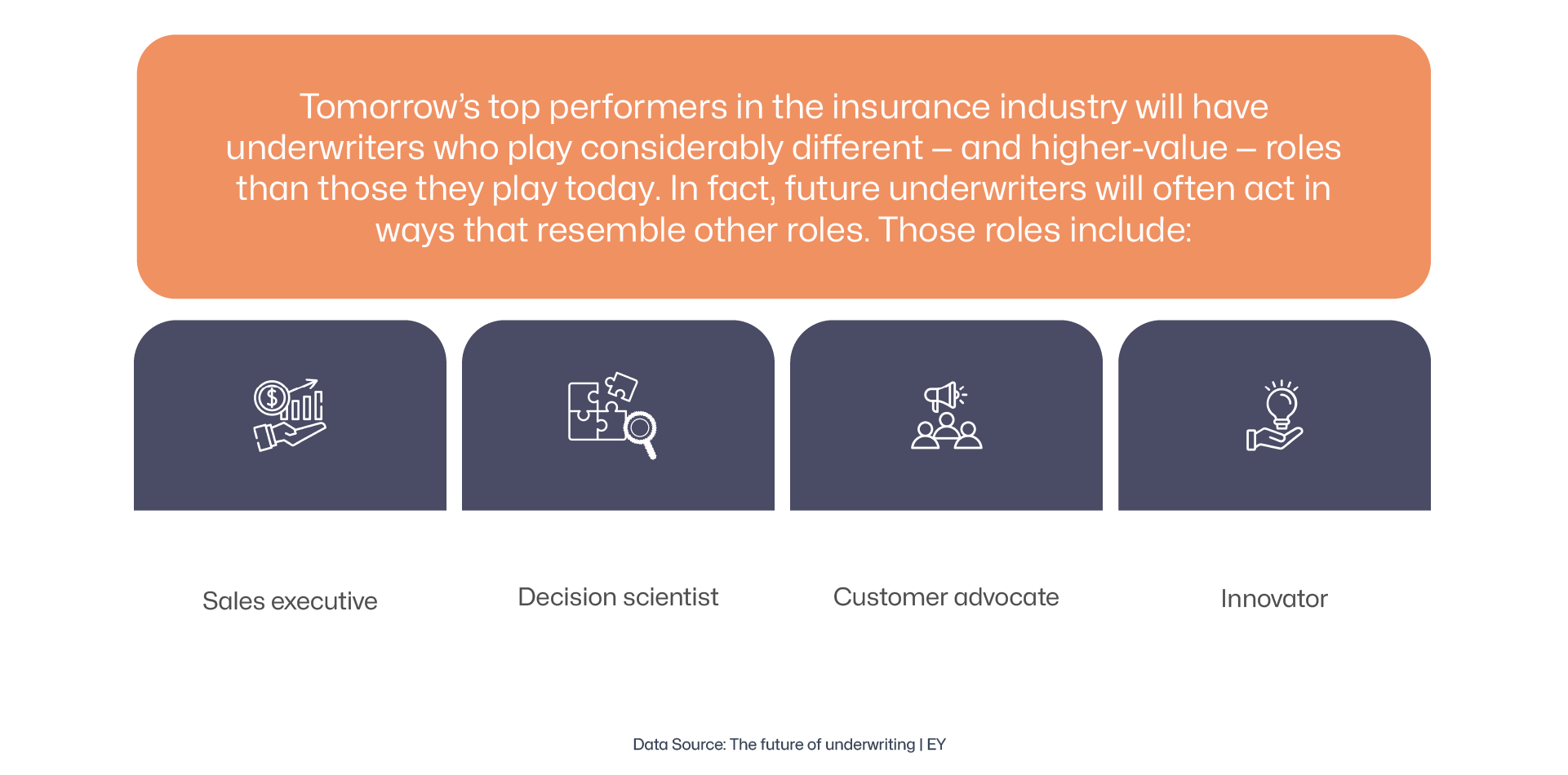

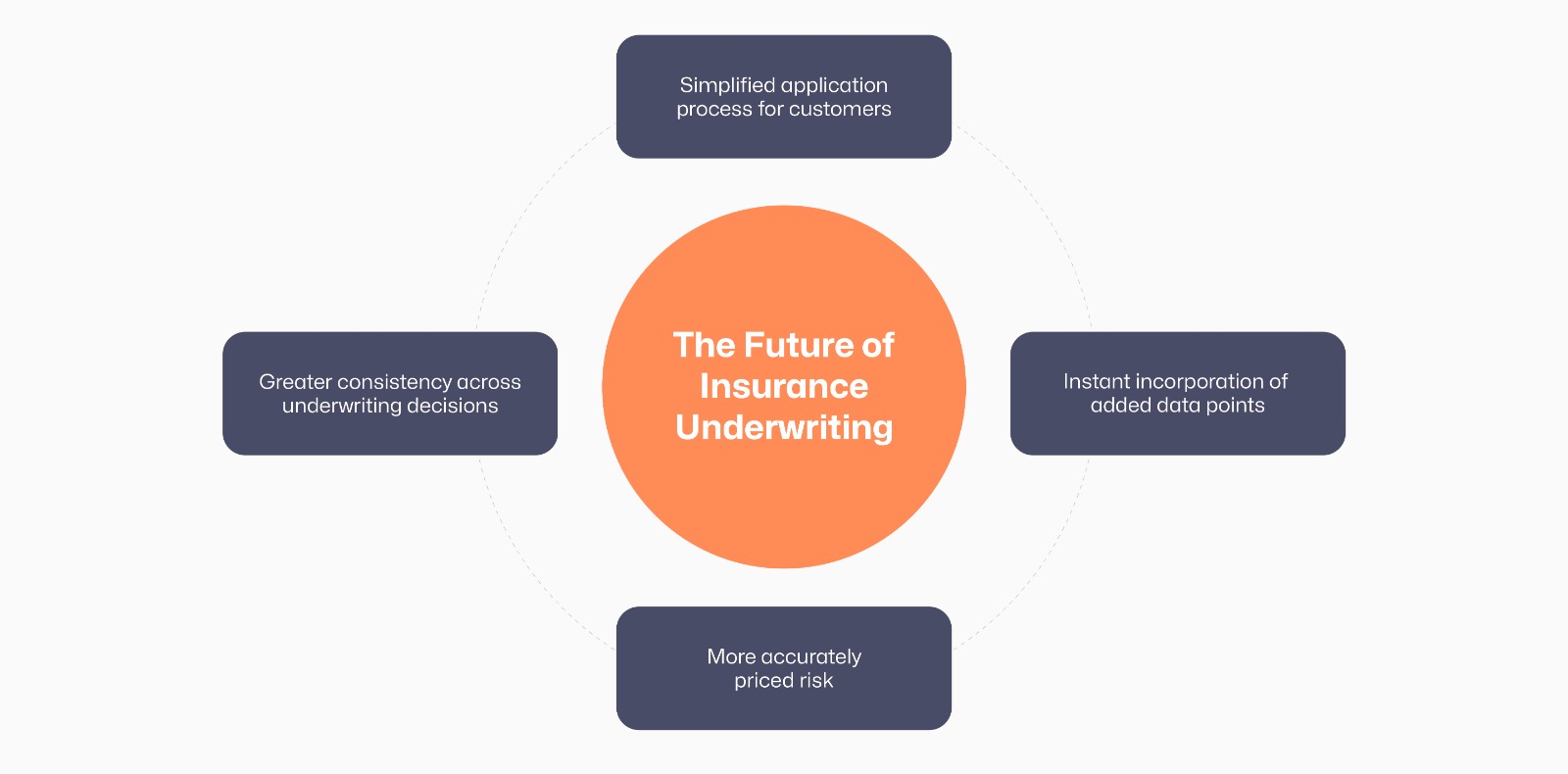

The Future of Insurance Underwriting

Real-time data from a wide range of sources offers a huge opportunity for insurance companies to expand their addressable market and offer relevant policies. With access to consumer-permissioned data, insurers can also benefit from time and cost savings through automation. For example, verification of claims and establishing premium levels can be accelerated. It also allows insurers to offer greater transparency, strengthening credibility and trust.

In fact, the potential to improve customer experiences and profitability is immense. Personalised real-time notifications and alerts are a prime example of this. Plus, personalised recommendations enhance cross-selling and upselling efforts. Fraud detection and prevention are possibly the most important benefits of data analytics for insurance. Powered by analytics, insurers can future-proof their business, proactively responding to emerging challenges and opportunities.

Technologies that are likely to play a significant role in shaping the future of insurance underwriting include AI/ML big data. Supported by trusted insurtech companies, underwriters grow to build value for insurance companies.

Bibliography (Last accessed on September 27, 2024)

- https://assets.ey.com/content/dam/ey-sites/ey-com/en_us/topics/financial-services/ey-the-future-of-underwriting.pdf?download

- https://www.statista.com/statistics/871513/worldwide-data-created/

- https://www.measureone.com/blog/insurance-underwriting-technology-enhancing-insurance-underwriting-sets-with-real-time-data

- https://www.grandviewresearch.com/horizon/outlook/insurance-analytics-market/india

- https://global.hitachi-solutions.com/blog/future-of-underwriting/

- https://www.inaza.com/blog/why-is-data-integration-crucial-for-insurance-underwriting

- https://www.easysend.io/blog/the-digital-shift-how-data-intake-is-reshaping-insurance-underwriting

- https://www.zopper.com/blog/understanding-opd-benefits-in-health-insurance-in-india