Contents

Retail credit is growing faster than ever, but the risk curve is rising just as sharply. In the last year alone, NPAs in unsecured retail loans climbed to 1.8%, compared to 1.2% for overall retail. Every percentage point there translates to thousands of crores in stressed assets and sleepless nights for credit heads.

With insurance penetration stuck at 3.7% of GDP, most borrowers still walk into loans without a safety net. And when shocks hit - job loss, medical bills, business closure, the fallout lands squarely on the lender’s books. Loan protection insurance isn’t a nice add-on anymore. It’s one of the few crucial levers left to keep portfolios resilient while growth continues.

India’s Risk Landscape in 2025: Why Default Protection Matters

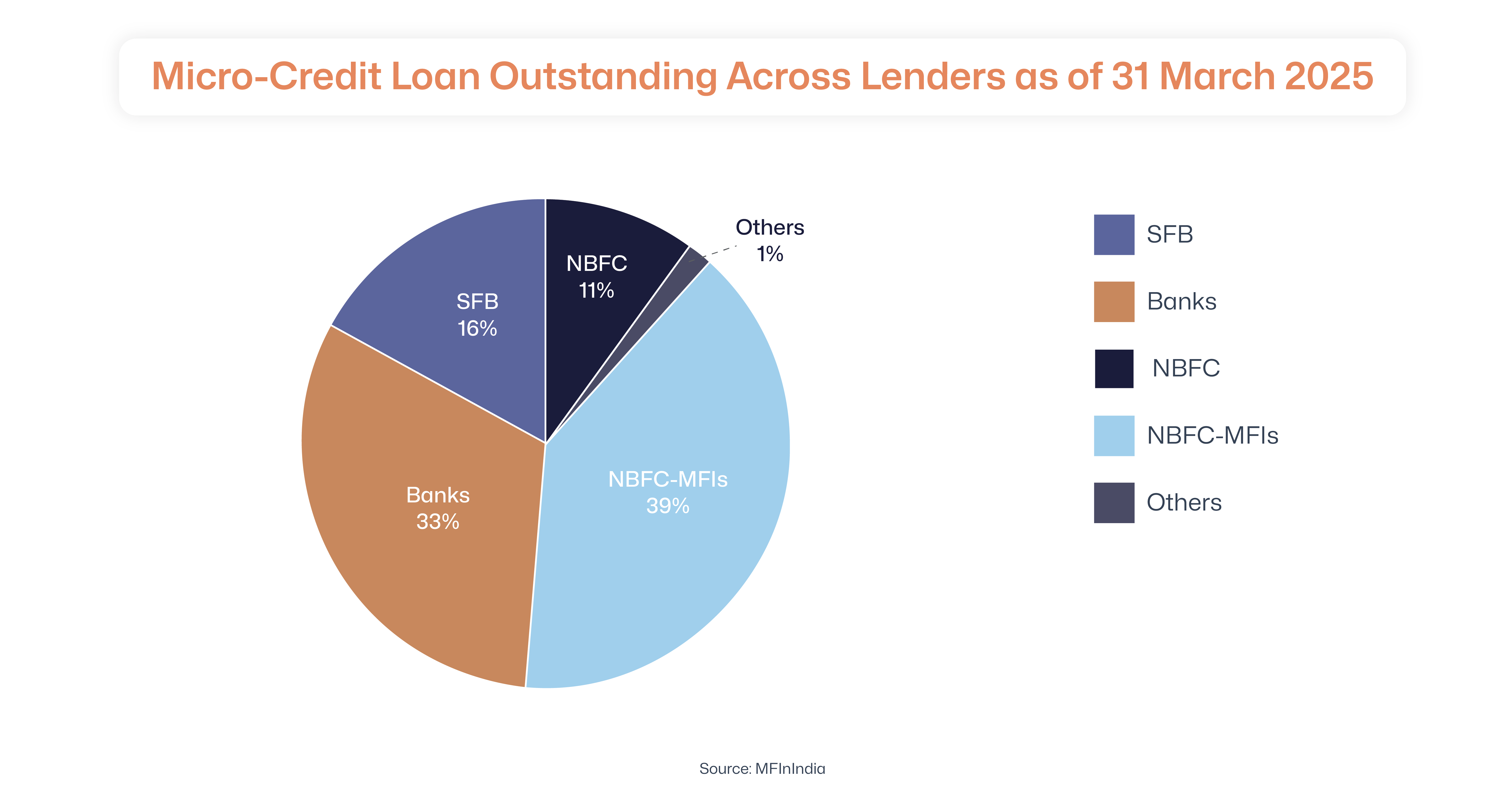

Despite improvements in banking health, risks remain. The Reserve Bank of India’s Financial Stability Report projected the gross NPA ratio to fall to 2.5% by March 2025 (from 2.8% in March 2024). Actuals have shown 2.3-2.8% across segments, reflecting stronger balance sheets. But for microfinance, the story is different: PAR 31-180 days surged to 6.2% by March 2025 (vs. just 2.0% a year earlier).

At the same time, India’s insurance penetration slipped to 3.7% of GDP in FY24, with life insurance at 2.8% and non-life at 0.9%. This indicates a massive protection gap, especially among lower-income and credit-dependent households.

What key implications can it have? Without loan protection insurance, any health shock, job loss, or accident directly translates into missed EMIs, leading to defaults, credit bureau downgrades, and financial exclusion.

What “Default Offering” Should Mean in Practice

When we say loan protection insurance should be the default, it does not mean force-selling. Regulators, such as the RBI and IRDAI, are clear: borrowers must have the freedom of choice.

Here, “default” means that lenders proactively recommend credit life insurance or EMI protection plans at the time of loan disbursement, using clear disclosures, recorded consent, and refund options.

If done right, this will ensure:

- Borrowers safeguard their family and credit score.

- Banks/MFIs reduce loss-given-default (LGD) and smoothen recoveries.

- Insurers achieve scale without eroding trust.

Benefits of Loan Protection Insurance for Banks

1. Significantly Reduced Credit Losses & Faster Recoveries

Loan protection insurance (credit life or credit shield) ensures that, in covered events such as death or disability, the remaining principal is paid out swiftly, reducing Loss Given Default (LGD) for the lender. This both stabilises the bank’s balance sheet and accelerates recovery, freeing up capital.

2. Bancassurance Synergies with Responsible Cross-Selling

Through bancassurance partnerships, banks can leverage their internal distribution channels, such as branches and digital platforms, without maintaining their own insurance infrastructure. According to industry overviews, bancassurance enables economies of scope, enhancing distribution reach while effectively sharing commissions.

3. Ancillary Revenue That Customers Accept (when done transparently)

With non-life incurred claims ratios at ~82.5% in FY24, which is relatively healthy, products like credit shield insurance can generate incremental fee-based income that both banks and insurers value. As long as pricing is fair and disclosures are clear, customer trust remains intact.

4. Enhanced Customer Trust Through Protection

Banks that offer borrower protection plans and clearly explain their benefits differentiate themselves in crowded retail credit segments. Borrowers feel supported, which boosts loyalty and reduces complaint and drop-off rates.

Why Loan Insurance is Essential for MFIs

1. Protection Against PAR Shock

Microfinance clients are particularly vulnerable to shocks such as illness, crop failures, and accidents. The 6.2% PAR 31-180 in March 2025 highlights the fragility of borrower incomes in the MFI segment. Research on microfinance insurance products highlights its effectiveness in extending protection to underserved low-income groups. Embedding such coverage reduces the cascading borrower stress that otherwise inflates PAR (Portfolio-at-Risk).

2. Building Trust with Borrowers

When MFIs integrate loan protection insurance with respectful communication via vernacular materials or meetings, they reinforce their image as partners in resilience, not mere creditors. This strengthens borrower relationships and community reputation.

3. Embedded Insurance Cuts Cost and Improves Access

Case studies on microinsurance integrated with microfinance, particularly in India, demonstrate that insurance can be seamlessly bundled into loan processes, thereby reducing onboarding costs and expanding coverage.

4. Simplified Claims & Reduced Moral Hazard

Master policies covering groups, coupled with individual certificates, let MFIs manage claims centrally while providing transparency to families. This promotes trust and mitigates any incentives to default.

How Insurtech Brands Enable Insurance at Scale

- Embedded Distribution

Top insurtech companies in India provide APIs (Application Programming Interfaces) and SDKs (Software Development Kits) that enable lenders to integrate loan protection plans seamlessly into their loan origination workflows. From e-KYC reuse to instant policy issuance, everything happens within the loan app.

- Smart Pricing Using Alternative Data

With access to repayment behaviour, occupation data, and geolocation, insurtechs can price EMI protection plans more accurately, keeping premiums affordable for low-risk borrowers.

- Automated Claims

Insurtech-powered digital FNOL (First Notice of Loss), OCR-based document uploads, and straight-through claim settlement enable borrowers (or their families) to receive payouts quickly, thereby preserving lender-borrower trust.

- Compliance by Design

Features such as recorded consent flows, cooling-off refunds, and MIS-ready audit trails ensure that both banks and MFIs remain aligned with RBI and IRDAI regulations.